BGSENERGY 2012-11-12 - Annoncement of the conditional share purchase agreement

- Utworzono: poniedziałek, 12, listopad 2012 23:37

| typ raportu | Bieżący |

| numer | 35/2012 |

| data dodania | 2012-11-12T23:37:29 |

| spółka | BGSENERGY |

The Management Board of BGS Energy Plus announces that that on 8 November 2012 its 82% - owned subsidiary VOLTA EUROPE BGS Spółką z ograniczoną odpowiedzialnością, with a registered office in Warsaw, (“the Buyer") concluded Energobiogaz Spółka Akcyjna, with a registered office in Poznań, (“the Seller") a conditional share transfer agreement (“the Agreement") concerning 100 (one hundred) shares with a face value of PLN 50 (fifty zloty) each, to a total face value of PLN 5,000 (five thousand zloty) in the share capital of BENERGO spółka z ograniczoną odpowiedzialnością, with a registered office in Poznań, entered in the Register of Entrepreneurs of the National Court Register kept by the District Court for Poznań - Nowe Miasto and Wilda in Poznań, VIII Commercial Division of the National Court register, entry number KRS 0000332472, constituting a total of 100% of the share capital of that company and giving a right to 100 votes at the shareholders\' meeting, constituting 100% of the total number of votes, in exchange for a total price of PLN 520,014.52 (five hundred twenty thousand fourteen zloty and 52/100). The aforementioned price for the shares shall be paid in two tranches, according to the following:

a) the first tranche to the value of PLN 300,000 (three hundred thousand zloty) shall be paid on the date of conclusion of the Agreement,

b) the second tranche to the value of PLN 220,014.52 (two hundred twenty thousand fourteen zloty and 52/100) shall be paid by 1 June 2013, but no later than on the date of commencement of construction of a biogas plant, including the accompanying infrastructure, by BENERGO Sp. z o.o., and not earlier than within 5 working days of the date of bilateral signature of a protocol confirming the satisfaction of some of the conditions precedent, the payment of which is secured by means of an unconditional, irrevocable guarantee of BGS Energy Plus a.s.

The occurrence of the legal effects specified in the Agreement is conditional upon, among other things, the satisfaction of all of the following conditions:

1. the conclusion between the Seller and the Buyer of a transfer agreement concerning the amounts receivable by the Seller from BENERGO sp. z o.o. The amounts receivable are due to the Seller under the loans granted by the Seller to BENERGO Sp. z o.o. The acquisition of the said amounts receivable shall be effected at a price equal to the principal plus interest. * Detailed terms and conditions of the transfer agreement constitute a business secret;

2. the conclusion by BENERGO sp. z o.o. of a loan agreement with the National Fund for Environmental Protection and Water Management to launch the biogas plant investment, including the accompanying infrastructure;

3. obtainment and submission of documentation relevant for the investment implemented by BENERGO sp. z o.o., consisting of the construction of a biogas plant with the capacity of 1.89 MW, including the accompanying infrastructure;

4. conclusion by BENERGO sp. z o.o. of material agreements for supply of raw materials and other materials necessary for the operation of the biogas plant.

In the event that the conditions specified in points 1- 4 above are not satisfied by 1 June 2013, the Buyer shall have a right to terminate the Agreement.

According to the above agreement, the ownership title to the shares shall be transferred to the Buyer upon satisfaction of all of the following conditions: the payment by the Buyer to the Seller of the full price due for the shares and the payment by the Buyer to the Seller of the full price for the amounts receivable covered by the amounts receivable transfer agreement.

BGS Energy Plus and its board members are unrelated to Energobiogaz S. A.

Legal basis: § 3 section 2 point 2) of Attachment no. 3 to the Rules on Alternative Trading System (Current and periodic information submitted within the alternative trading system on the NewConnect market).

Osoby reprezentujące spółkę:

- Jindra Radilova - CFO

Załączniki:

Reklama AEC

Reklama NEWWEB

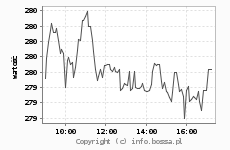

- Obroty

- *

- Wzrosty

- Spadki